Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

This documentation offers comprehensive details on using and developing applications on the Fantom Opera chain.

Opera is a blockchain and smart contract platform that provides developers with exceptional scalability and storage capabilities, while delivering a fast and seamless experience for users. Its native token is FTM.

The majority of this documentation aims to help users learn more about Opera and guide developers on building applications on the chain. to get started.

Coinbase Wallet comes preloaded with the Opera chain. As such, it should switch to Opera automatically when you visit an app.

Developers should build on the Opera chain due to its impressive performance, scalability, and low transaction costs, all enabled by its .

Opera provides fast transaction finality, typically within one second, which ensures a seamless user experience for applications. Additionally, the chain's compatibility with the Ethereum Virtual Machine (EVM) allows developers to easily port their existing Ethereum apps to Opera with minimal modifications

Furthermore, Opera's commitment to decentralization and high throughput positions it as a forward-thinking platform capable of supporting a wide range of applications, from DeFi to NFTs and beyond, making it a versatile and attractive choice for developers aiming to build next-generation blockchain solutions.

Follow the tutorials in the menu to get started!

Running a validator node on the Opera chain presents a unique opportunity to actively contribute to the security and decentralization of the network. By participating as a validator, you help validate transactions and create new blocks, ensuring the integrity and efficiency of the blockchain.

This involvement not only supports the broader ecosystem but also provides potential financial incentives through rewards distributed to validators. Additionally, being a validator offers a deeper understanding and engagement with blockchain technology, positioning individuals and organizations at the forefront of a rapidly evolving industry. It is a chance to be part of a community driving innovation and fostering a robust, decentralized future.

Follow the tutorials in the menu to get started!

With the previous proxy pattern, we can only have one logic or implementation smart contract. However, there are cases when we want to have one proxy with more than one logic smart contract. In this case, we need the diamond proxy pattern, which is also known as the multi-facet proxy pattern.

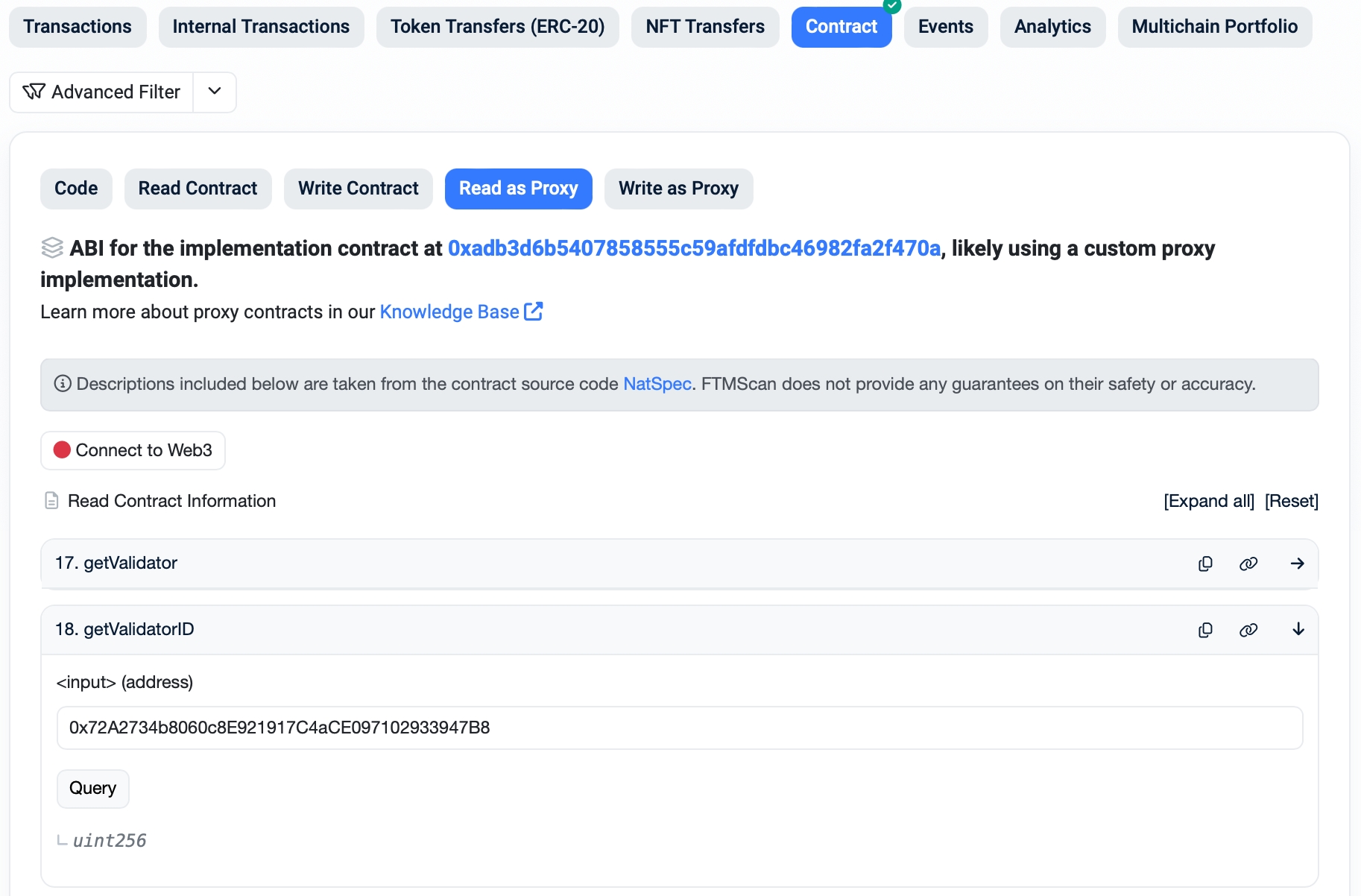

After verifying your proxy smart contract and its logic (implementation) smart contract, you can execute the functions via FTMScan. However, like the other EVM explorers, such as Etherscan, FTMScan can’t support a verified diamond proxy and its logic smart contracts, also known as facets. Fortunately, now we have a diamond inspector called Louper which also supports the Opera mainnet and testnet.

Here are two samples of a diamond proxy and its facets which can be inspected using Louper:

The Opera chain is secured using a proof-of-stake (PoS) mechanism.

In PoS on Opera, validators must lock their FTM (Opera's native token); if they act maliciously in the network, they lose their tokens. Validators are incentivized to act in the network's best interest as their own funds are at stake. Since validators do not need to perform computations, this approach is a much more energy-efficient alternative to proof-of-work for achieving resistance to Sybil attacks!

A Sybil attack is an attack where a malicious actor runs a large number of validators to allow them an unsafe amount of influence over the network. PoS makes it costly to set up these validators and allows the network to punish validators for malicious behavior, increasing the costs of attacks.

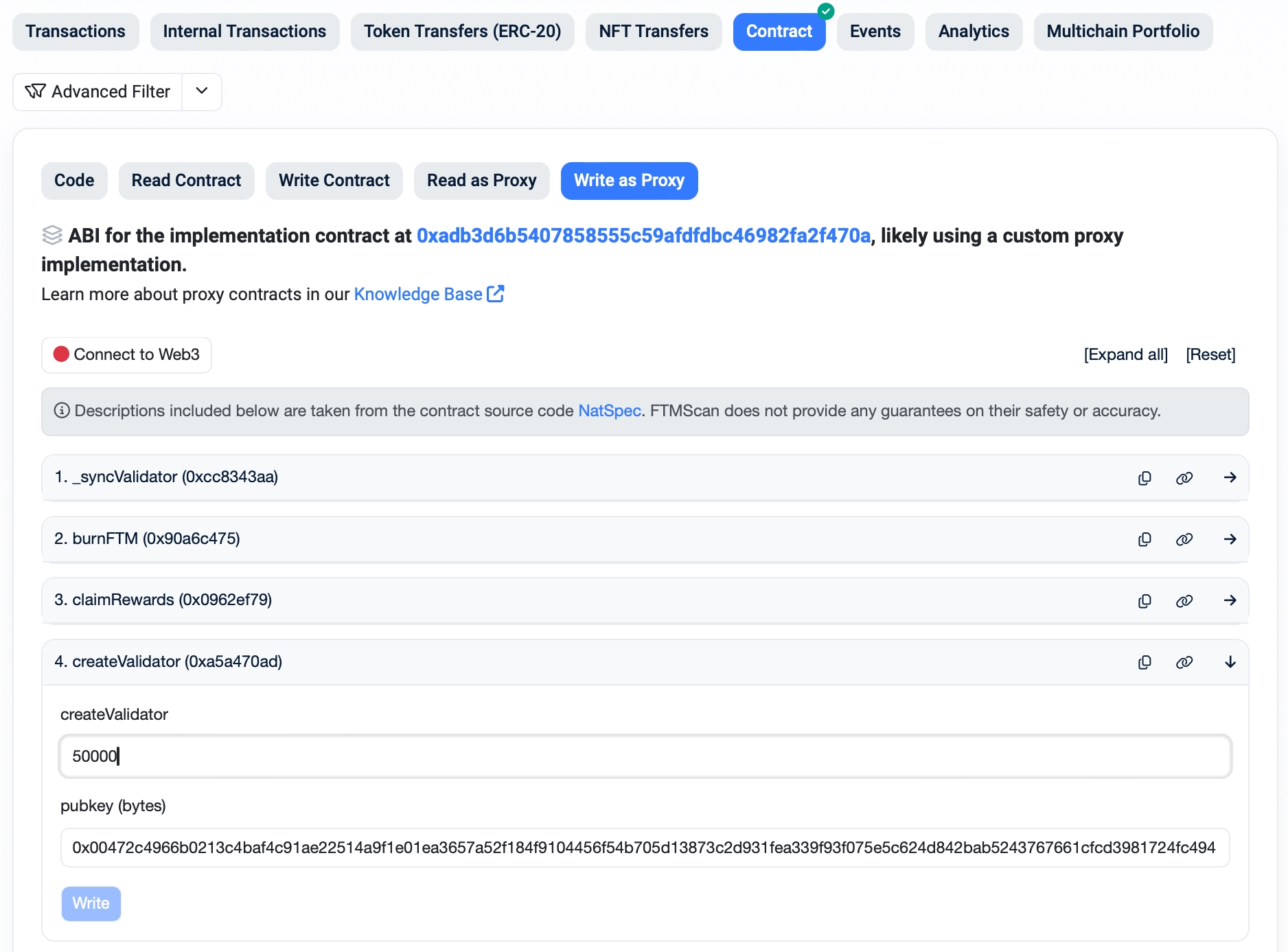

Opera requires validator nodes to lock up at least 50,000 FTM to validate transactions and produce blocks.

fWallet is the official wallet for the Opera chain, required to participate in staking or governance.

You can connect to fWallet using various third-party wallets, including Rabby, MetaMask, Coinbase Wallet, and others.

With fWallet, you can:

Send FTM and other tokens

Swap tokens, powered by OpenOcean

Governance on a decentralized platform empowers token holders to actively shape and influence its future, ensuring it evolves in the right direction. On Opera, governance is an on-chain process that lets FTM (Opera's native token) stakers submit and vote on proposals that determine changes to the platform’s mechanics and tokenomics.

To vote on a proposal, go to the governance section in your fWallet, open an active proposal, and cast your vote on the choice with which you agree most. Note that you’ll need to stake FTM tokens to vote. Each token equals one vote.

When you delegate your stake to a validator, your voting power is still equal to the number of FTM tokens you’ve staked. However, if you choose not to vote on a proposal, your voting power is given to your validator who adds your votes to their own. This helps to increase overall participation and prevent low voting turnouts. Once you do vote, they lose your voting power.

Governance proposals outline potential actions that aim to improve Opera. If you’ve staked FTM, you can submit one by paying a 100 FTM fee through the governance section of your .

Proposals aren’t restricted to a simple yes or no option — voters can express their level of agreement across a range of custom options, which allows for more nuanced decision-making.

Proposals have a set date by which a minimum number of voters must have participated, and they must have agreed above a certain percentage. For most proposals, at least 55% of FTM stakers must cast their vote, and the average agreement among them must also be 55% or higher for the proposal to pass, both of which need to be achieved by a certain date.

If a proposal passes, the Fantom Foundation will implement the proposed changes or upgrades.

Rabby Wallet includes a feature that automatically switches the wallet to the appropriate chain based on the site you visit. As such, it should switch to Opera automatically when you visit an app.

You can bridge assets to Opera using the protocols below to unlock access to a wealth of apps with instant, cheap transactions.

Use PortalBridge to bridge USDC from Ethereum to Opera. Upon completion, you will receive USDC.e on Opera, the canonical stablecoin for our chain.

You can only bridge the USDC stablecoin from Ethereum and not from any other chains.

To bridge any asset from most EVM chains to Opera, use . Powered by Axelar, Squid automatically swaps and bridges assets for you. It leverages existing DEXs on each chain to swap and bridge native tokens.

Axelar handles all cross-chain gas conversion from the source-chain token to the destination-chain token, so users don’t need to maintain wallets on different chains, hold tokens for gas fees, or make multiple transactions to complete a transfer.

For example, you can bridge ETH on Arbitrum to FTM on Opera in one step.

The API server delivers a high-performance GraphQL API for Opera, offering access to both low-level and aggregated blockchain data for remote clients. This allows client developers to focus on their application's business logic, without having to manage the complexity of data and entity relationships within Opera.

Verifying your smart contract creates transparency, thus increasing trust. Follow these steps to verify your smart contract on Opera:

Go to .

Input your contract address.

Choose compiler type (single file is recommended).

Fantom has migrated to the new and its S token. Users holding FTM can .

Users holding FTM: If you're a user holding FTM wanting to upgrade to the S token, follow the instructions on the . Users holding app tokens: If you're a user holding an app token on Opera, follow the instructions on the.

If you're an Opera app developer wanting to migrate to Sonic, follow the instructions on the .

If you run a validator node on Opera and you choose to migrate, please follow these steps:

Our Opera chain provides developers with exceptional scalability and storage capabilities while delivering a fast and seamless user experience.

Opera achieves beyond 2,000 transactions per second with near one-second finality for immediate, irreversible transactions and utilizes a cutting-edge storage system for efficient data management.

Learn more about the Opera technology stack:

Opera uses database storage to store its world state, which includes account information, virtual machine bytecode, smart contract storage, etc. This database has a feature called live pruning, which removes historical data automatically, reducing storage needs for validators as the blockchain grows.

Previously, pruning required validator nodes to go offline, risking financial and operational issues for them. Now, validators can use live pruning without going offline, ensuring continuous operation and saving on disk space and costs by discarding historical data in real-time.

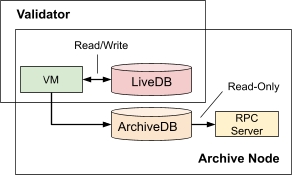

Live pruning works by splitting the database into two types: LiveDB and ArchiveDB. The LiveDB contains the world state of the current block only, whereas the ArchiveDB contains the world states of all historical blocks. Validators use only LiveDB, while archive nodes have both LiveDB and ArchiveDB to handle historical data requests through the RPC interface.

Opera's database storage uses efficient tree-like or hierarchical structures, which simplifies data retrieval. Importantly, it still provides cryptographic signatures for a world state and archive capabilities using an incremental version of a prefix algorithm. Additionally, it utilizes a native disk format instead of storing the world state indirectly through key-value stores like LevelDB or PebbleDB.

Functions

name()

symbol()

decimals()

totalSupply()

balanceOf(account)

transfer(recipient, amount)

allowance(owner, spender)

approve(spender, amount)

transferFrom(sender, recipient, amount)

increaseAllowance(spender, addedValue)

decreaseAllowance(spender, subtractedValue)

_transfer(sender, recipient, amount)

_mint(account, amount)

_burn(account, amount)

_approve(owner, spender, amount)

_setupDecimals(decimals_)

Compile your code into bytecode

Deploy your Variable-cap Asset by sending your code in a transaction to the Fantom network

Navigate to the Explorer to check that your token has been created

You can use the _mint function to create additional units of the token

10% to the Ecosystem Vault

15% to Gas Monetization

70% to validators

We utilize several technologies to ensure the API functions effectively. If you intend to run your own instance, please review our setup and ensure you have at least a basic understanding of these technologies before proceeding.

First, you will need access to the Opera full-node Lachesis RPC interface. While you can use a properly configured remote interface, this may significantly impact performance and potentially compromise the security of your deployment. Be mindful of the security risks associated with exposing the RPC to outside access, especially if you enable "personal" commands on your node while storing your account keys in the Lachesis key store. We recommend using a local IPC channel for communication between the Lachesis node and the API server. The IPC interface is available by default. Refer to the Lachesis launch instructions and go-opera repository for detailed deployment and configuration guidance.

Some aggregated and relationship data are stored off-chain in a MongoDB database, particularly data that is not easily accessible via the basic node RPC interface. This includes references between an account and its transaction history or the chronological position of transactions. The API server initializes the database, populates it with historical data, and keeps it synchronized with the full node through internal subscriptions. While you don't need to manage the database separately, you must provide a well-configured and reliable database connection address to the API server.

Finally, the server is developed using Go, a fast, secure, and excellent programming language. You will need to install and configure a Go development environment to build your copy of the API server. Please follow the official Go installation instructions.

Finally, the server itself is developed using Go, excellent, fast and secure programming language. You will need to install and configure Go development environment to be able to build your copy of the API server. Please follow the official installation instructions.

Wait at least 2 epochs (≈15 minutes) before you shut down your node.

Turn off the node and back up your validator key securely.

Here is an overview of the migration timeline and associated events:

Sonic launch

December 18, 2024

Migration period

Launch onwards

Two-way swap between FTM and S

December 18, 2024 – March 31, 2025

One-way swap (FTM to S only)

March 31, 2025 onwards

Staking is a vital part of securing the Opera chain through proof-of-stake. Validator nodes must stake FTM, incentivizing them to act honestly in block production as they risk losing their stake otherwise.

However, FTM holders can also participate by staking their FTM and delegating it to an existing validator node to earn rewards. Opera offers several staking benefits, including no minimum stake, no mandatory lock-up period, and liquid staking services!

Head to fWallet.

Click on Staking

Choose the amount of FTM you would like to stake and then click on Choose a validator

Click on Create new delegation

Choose a validator from the list

Click Stake and continue

Choose between the 1.8% base APR with no lock-up period or lock your stake for up to 365 days for an increased APR

Once you have staked, you’ll begin to earn rewards actively. 15% of the rewards you earn will be distributed as a fee to the node to which you’ve delegated your stake.

To increase your FTM stake amount at any time, you can repeat the process above to create a new delegation. As such, you can create several delegations with multiple lock-up periods.

The Rewards section of the Staking page shows the amount of FTM you have earned from staking.

You can compound these rewards into your delegations to increase your stake and earn more rewards, or you can claim all rewards to receive the FTM directly in your wallet.

Note that there's a seven-day unbonding period when you unstake your FTM. After initiating the unstaking process, you must wait for seven days. Once this period has passed, return to the Staking page, navigate to the Withdraw tab, and withdraw your FTM to your wallet.

Additionally, while it is possible to unstake your FTM before your chosen lock-up period ends, you’ll receive only half of the base rate of 1.8% APR rewards; however, since you receive rewards actively, the penalty will be deducted from your staked FTM as you unstake.

For example, you stake and lock 100,000 FTM for one year, giving you a 6% APR, which equals 6,000 FTM in total rewards. Approximately at day 300, you’ll have received almost 5,000 FTM, at which point you decide to unstake before the one-year period ends.

Your updated APR is 0.9%, half the base rate. With your 100,000 FTM, your rewards would equal 900 FTM. However, since you’ve already received 5000 FTM, you’ll receive only 95,900 FTM when you unstake to account for the extra 4100 FTM in rewards you forfeit by unstaking early.

As such, you will never receive less FTM than you staked originally.

Open your MetaMask extension

Click the network icon in the top-left corner

Click Add Network

Click Add a Network Manually

Fill in the details below:

Network Name: Opera

RPC URL: https://rpcapi.fantom.network

Chain ID: 250

Currency Symbol: FTM

Click Save

Switch your MetaMask wallet to Opera

Open your MetaMask app

Click the network drop-down list at the top

Click Add Network

Click Custom Networks

Fill in the details below:

Network Name: Opera

RPC URL: https://rpcapi.fantom.network

Chain ID: 250

Currency Symbol: FTM

Click Add and Confirm

Switch your MetaMask wallet to Opera

To add the Opera testnet to MetaMask, follow the steps above but replace the network details with:

Network Name: Opera Testnet

RPC URL: https://rpc.testnet.fantom.network/

Chain ID: 0xfa2

Currency Symbol: FTM

Block Explorer URL:

You can access the Opera Testnet Faucet for some free testnet FTM.

Click on My Ledger

Under App Catalog, find Ethereum and click Install

Since Ledger lacks a native Opera application, we use the Ethereum application as it supports all EVM-compatible chains, including Opera.

Follow the instructions to install the Ethereum app

Click Add Account

Select FTM in the drop-down list and add the account

Open Ledger Live

Click Accounts

Click on your Fantom account

Click Receive

Choose your Fantom account in the drop-down list

Click Continue

Verify the address on your Ledger device and then copy

Send FTM to this address from CEXs or other wallets

To use apps on Opera with your Ledger device, you must connect it to a Web3 wallet first, such as Rabby or MetaMask.

Open your Rabby Wallet extension

Click on your wallet address at the top

Click Add New Address and then Connect Hardware Wallets

Click Ledger

Connect your Ledger and click Next

Click Allow and choose your Ledger device in the list

Choose your address on the list that contains FTM and click Done

You can now interact with apps on Opera using Rabby. Whenever you need to sign a transaction or message, Ledger will prompt you to approve it on your physical hardware wallet.

Open your MetaMask extension

Click the drop-down list at the top

Click Add Account or Hardware Wallet

Click Add Hardware Wallet

Click Ledger

Click Continue and choose your Ledger device in the list

Choose your address on the list that contains FTM and click Unlock

You can now interact with apps on Opera using MetaMask. Whenever you need to sign a transaction or message, Ledger will prompt you to approve it on your physical hardware wallet.

Choose the open-source license.

Click Continue.

If you select a single file as compiler type, then you can use a library like sol-merger to flatten your contract. It creates a single file that contains all the imports.

Make sure there is only one line of // SPDX-License-Identifier. If there are multiple lines of this, remove them except the first one.

Choose yes for optimization (if you deployed your contract using Hardhat).

Paste the source code.

If the contract has a constructor, then you need to create the ABI code for the values passed to the constructor. Use https://abi.hashex.org/. Copy the result and paste it to the Argument (Constructor) section.

Tick the box to indicate that you are not a robot.

Verify and publish.

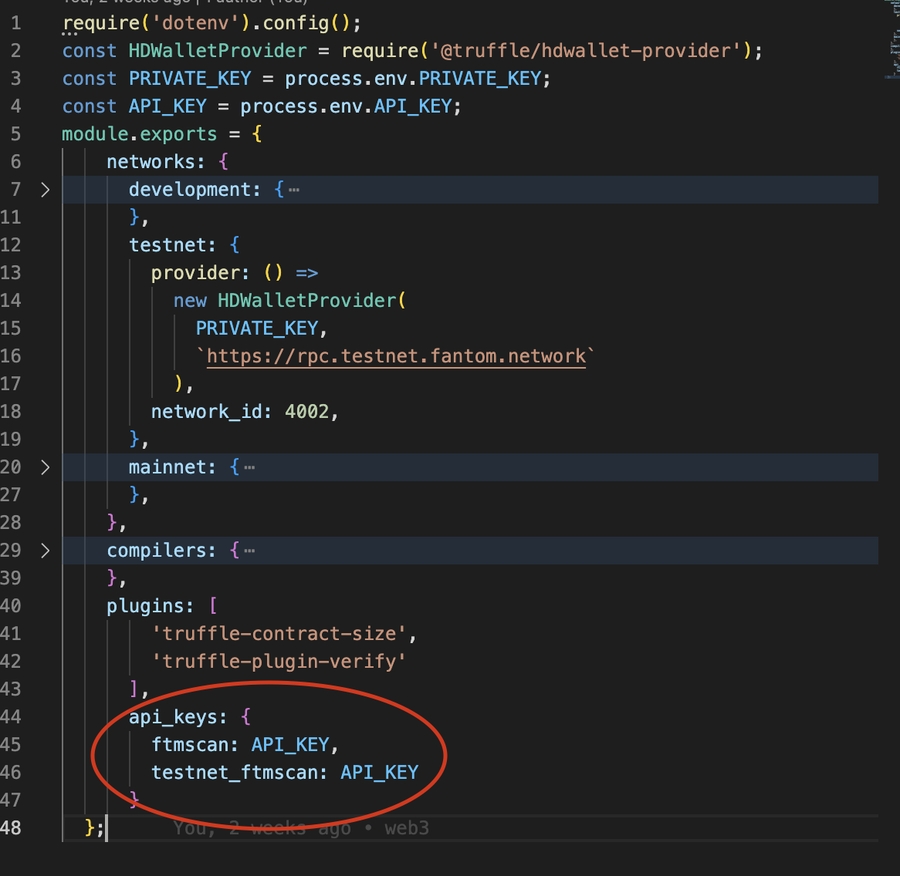

You can verify your contracts via a Hardhat or Truffle command line. You need to get a scan API key from FTMScan first. Register if you do not have an account and then create a scan API Key. Hover over your username and then choose API Keys. You then can create an API Key.

You then need to store the API Key in a .env file which is read by your configuration file, such as:

API_KEY={your API Key}. Your Hardhat configuration hardhat.config.js may look like this:

Your Truffle configuration truffle-config.js may look like:

Below are two examples of command lines to verify your contract, one in Hardhat and the other in Truffle configuration.

In the above examples, it is assumed that you supplied some values to the constructor when you deployed the contract.

Using the Hardhat command line: When verifying using the Hardhat command line, you need to specify the values in a JavaScript file. In the example above, it is assumed that the file is under the scripts folder. Please refer to the Hardhat documentation.

Using the Truffle command line: You do not need to specify any value that you passed to the contract's constructor. Truffle records these when you deploy the contract.

If you use Hardhat, you can also use the verify:verify command in a script to verify your contract. You can include this script in your deployment script. Here is an example.

Staking on Opera involves locking up a certain amount of FTM (Opera's native token) to support the network's operations, such as block production and validation. In return, users receive rewards in the form of additional FTM. This process helps secure the network and maintain its integrity.

Validators are required to stake at least 50,000 FTM to validate transactions and produce blocks to earn rewards. However, users can delegate any amount from 1 FTM to existing validators to earn rewards without needing the technical knowledge to operate a validator.

Opera uses a fluid staking model. Users can either stake without a lock-up period for the minimum annual percentage rate (APR) or select a lock-up period between 14 and 365 days for an increased APR. This model combines long-term sustainability for the network with flexibility for stakes.

In the fluid staking model, your effective APR:

Increases proportionally with your lock-up period

Decreases proportionally with the average lock-up period of all stakers

Decreases proportionally with the total amount of FTM staked by all stakers

To get an estimate for potential rewards, please use our .

There are two ways to participate in staking on Opera:

Please note that an official binary distribution is not available at the moment. To build your own GraphQL API, you need to have the following:

Working MongoDB database installation.

Go version 1.13 or later .

up and running.

You do have another option. For initial testing and development, you can use our own testing playground. The API server is deployed at https://xapi2.fantom.network/api for regular GraphQL queries and at https://xapi2.fantom.network/graphql for WebSocket subscriptions.

Feel free to connect and try your queries. Fine-tune your application before committing to deploying your own instance.

Building your API server is a fairly straightforward process. First, clone the repository to your local machine. Do not clone the project into $GOPATH, due to the . Instead, use any other location.

Once you have the copy on your machine, build the executable:

To run your copy of the API server, simply run:

The API server already contains some most common configuration options as default values, and you don't have to change them most of the time. The default values are:

Network binding address is localhost.

Default listening port is 16761.

Default Lachesis IPC interface is ~/.lachesis/data/lachesis.ipc.

MongoDB connection address is mongodb://localhost:27017.

If you want to change one of the default values, you need to create a configuration file. The API server can read configuration options from several configuration formats, namely JSON, TOML, YAML, HCL, envfile, and Java properties config files.

Please choose the one you are most familiar with. The name of the configuration file is expected to be "apiserver" with an extension that corresponds with the file format of your choosing.

Example YAML file looks like this:

You can keep the config file in the same location as the API server executable, or you can save it in the home folder under the .fantomapi sub-folder. On MacOS, the expected path is Library/FantomApi.

Here’s an example of signing a transaction to update the blockchain state by creating a transaction. This example demonstrates updating a state variable in a deployed contract:

We call the function setGreeting and store the transaction in a variable tx

We then pass the tx along with contract details

The function signTransaction creates a block of data containing all the necessary information like gas price, contract information, network information, etc., and calls the web3 method to sign the transaction.

We have added to fetch the gas price:

web3.eth.getGasPrice() gets the latest gas price

web3.eth.getFeeHistory() gets the gas price using custom parameters, such as:

No. of blocks (the number of previous blocks it searches)

getFeeHistory() will calculate an average of the blocks (mentioned in the first parameter) and figure out the best gas prices based on the percentile for slow/average/fast options. This API also returns the baseFeePerGas (introduced after EIP-1559) which is added to the gas prices outputted by the above call.

Rest of the Web3 API calls and examples on Opera:

We have added two ways to sign a transaction with a of transferring FTM between accounts.

The takes a simple approach and uses the predefined web3 method to determine the gas price required to send FTM between two accounts.

transfers with additional parameters in its transaction block.

The code snippet mentioned above employs the variables maxFeePerGas and maxPriorityFeePerGas.

Following the London fork, each block now includes a baseFeePerGas. This base fee represents the minimum cost required for sending a transaction on the network. Unlike miners, the network itself determines the base fee. The base fee varies from block to block depending on the previous block's capacity.

When submitting a transaction, you must also provide a "tip" in the maxPriorityFeePerGas field. To ensure that the miner has an incentive to process your transaction, the minimum tip amount you should offer is 1 wei. The likelihood of your transaction being included in a block increases as you offer a higher tip.

To initiate a transaction on the network, users have the option to specify the maximum amount they are willing to pay for their transaction to be executed. This parameter is called maxFeePerGas. However, for a transaction to be successfully executed, the max fee specified must be greater than or equal to the sum of the base fee and the maxPriorityFeePerGas.

Liquid staking on Opera allows users to unlock liquidity from staked assets, opening new opportunities within DeFi. Traditionally, if you stake FTM, you lock your tokens to support the network's operation and security in exchange for rewards. However, doing this makes your FTM illiquid, meaning they cannot be used for other DeFi opportunities until they’re unstaked.

On Opera, two protocols aim to fix this limitation: Beethoven X and Ankr Protocol. Learn about them below.

Liquid staking addresses the limitations of traditional staking by delegating your tokens to a validator and then minting synthetic tokens that represent the staked assets on a 1:1 basis. These tokens can then be freely traded and used in DeFi protocols for lending, borrowing, or earning additional yield while the original assets remain staked and continue earning staking rewards.

For example, suppose you stake 100 FTM through one of the liquid staking providers below. In that case, you receive the equivalent value in their FTM liquid staking tokens, which you can use in any DeFi application that supports them.

Liquid staking on Opera enhances the utility of its native token and enriches its DeFi ecosystem, making it more attractive to users seeking to maximize the productivity of their assets. This mechanism fosters greater capital efficiency within the network, allowing users to participate in securing Opera while also engaging in other DeFi activities without having to choose one over the other.

Beethoven X is a DeFi platform on Opera that offers liquid staking through its sFTMx token. Follow these steps to liquid stake using Beethoven X:

Head to

Select how many FTM you wish to stake

Click Stake and confirm in your wallet

You have now staked your FTM through Beethoven X and received an equivalent value in sFTMx tokens! These tokens are reward-bearing, meaning their quantity is stable, but they gain in value such that their redemption ratio grows daily to reflect Opera staking rewards. The tokens can now also be used across various DeFi applications while they continue to earn staking rewards from the Opera chain.

To unstake your FTM, head to the Unstake tab. However, please note that any FTM tokens you unstake will only be available for withdrawal after 7 days, identical to the waiting period required for unstaking native FTM. As an alternative to unstaking, you can swap from sFTMx to FTM using Beethoven X’s DEX on the Swap page.

15% of the staking rewards that you earn are given to the validator on which your underlying FTM is staked, and then Beethoven X takes a 10% protocol fee from the remaining rewards that you receive. about liquid staking on Beethoven X.

Ankr offers liquid staking on Opera through its ankrFTM token. Follow these steps to liquid stake using Ankr:

Visit

Select how many FTM you wish to stake

Click Get ankrFTM and confirm in your wallet

You have now staked your FTM through Ankr and received an equivalent value in ankrFTM tokens! These tokens are reward-bearing, meaning their quantity is stable, but they gain in value such that their redemption ratio grows daily to reflect Opera staking rewards. The tokens can now also be used across various DeFi applications while they continue to earn staking rewards from the Opera chain.

To unstake your FTM, head to the , scroll to the Liquid staking section, and click the minus symbol next to the ankrFTM token. Note the unstaking period given above the Unstake button. As an alternative to unstaking, you can swap from ankrFTM to FTM on various DEXs.

15% of the staking rewards that you earn are given to the validator on which your underlying FTM is staked, and then Ankr takes a 15% technical service fee from the remaining rewards that you receive. about liquid staking on Ankr.

The Gas Monetization program offers apps a 15% share of the gas fees they generate and aims to provide high-quality apps with a sustainable income, retain talented creators, and support network infrastructure.

With Gas Monetization, we seek to foster a thriving ecosystem for builders, similar to the ad-revenue model on traditional web platforms.

Approval to the Gas Monetization program is at our discretion. .

Upon approval to participate in the program, apps will begin to earn 15% of the gas fees they generate. The FTM earned through Gas Monetization can be used at the apps' discretion.

Every quarter, the top 12 apps on Opera that generated the most gas will receive a bonus. These 12 projects are divided equally into four tiers that determine the amount of FTM they receive:

Tier 1 (top three projects): 40% of FTM

Tier 2 (next three projects): 30% of FTM

Tier 3 (next three projects): 20% of FTM

Tier 4 (final three projects): 10% of FTM

The quarterly bonus comes from the 15% deducted from transaction fees of apps not participating in Gas Monetization. While on Opera are allocated to the Gas Monetization program, the fees from non-participating apps are pooled and distributed as the quarterly bonus.

In Gas Monetization, double counting is prevented by accurately tracking gas consumption within the EVM. The system traces all internal calls in a transaction and splits the reward based on the gas each sub-operation consumes.

This ensures that the sum of rewards across different projects never exceeds the total gas fee. An example is given below.

A trade consumes 100,000 units of gas with a total GasM fee of 0.017 FTM.

Inside this transaction, there are operations related to two projects: Project A and Project B.

Project A, the DEX aggregator, is responsible for consuming 37,000 units of gas, while Project B, the liquidity pool on the DEX that the aggregator interacts with, uses 63,000 units of gas.

The total reward is split based on the gas consumption:

We reserve the right to suspend rewards to participating apps for any reason deemed necessary at its sole discretion, including fraudulent user activity or the overall well-being of the Opera ecosystem.

Smart contract unit tests are written in JavaScript. In this tutorial, we provide two examples of unit testing using Hardhat and Truffle.

https://github.com/Fantom-foundation/unittestexample-hardhat

Each example repository contains the following:

contracts Folder: Contains smart contract files.

test Folder: The unit test files are under the test folder.

README.md File: Contains instructions for compiling, testing, deploying, and verifying the smart contracts.

In the above examples, unit tests are included in one single JavaScript file. However, you can have as many tests and files as you need for your project. In the examples, there are three types of tests:

Checking if a value is what is expected

Checking if an event is fired with the correct arguments

Checking if a revert has occurred

Minimum hardware requirements:

AWS EC2 m5.xlarge with 4 vCPUs (3.1 GHz), SSD (gp2) storage

CPU > 3.0 GHz

SSD (or NVMe SSD) (N.B. AWS gp2 has up to 16000 IOPS)

Network Bandwidth: 1 Gbps (N.B. m5.xlarge has up to 10 Gbps)

Storage: Depending on the types of your nodes.

Equivalent or better specs are recommended.

To save machine's storage, you may use pruning (for further ).

Manual pruning:

Stop the node, then issue the following command:

./opera snapshot prune-state

Automatic pruning:

You can run a node with the --gcmode flag, and it will prune old data on the fly.

One can specify the cache size by --cache <size in MB>. The default value of cache size is 3200 MB. Nodes tend to sync faster with a larger cache size.

Transactions in blocks aren't necessarily sorted by gas price. Even though transactions in each event and in the txpool are sorted by gas price, events are sorted by their topological ordering in the DAG. A new block includes transactions from multiple confirmed events in that topological order, which is used by our .

It is recommended that you make sure to submit transactions with a reasonable gas limit amount.

This is because transactions with excessive gas limits will have less chance to be included, due to a gas limit for each block, and the originating power of validators. There is penalty of 10% for unspent gas. This penalty is introduced as a disincentive against excessive transaction gas limits.

The disincentive is required because Opera is a leaderless decentralized aBFT chain and blocks are not known in advance to a validator (unlike Ethereum miners) until blocks are created from confirmed events. There is no single proposer who can originate transactions for a whole block and so validators don't know the used gas in advance.

This penalty will be increased shortly (up to 50%) to prevent transactions with excessive transaction gas limits.

is a free contract-centered blockchain explorer created by . First released in 2018, Contract Library continuously decompiles and analyzes all deployed contracts for human inspection and offers a platform for exposing vulnerabilities. Contracts added to the Opera chain appear in the library almost immediately.

Contract Library offers users the ability to:

Contract Library’s debugger is orders of magnitude more scalable than alternatives on other networks, enabling debugging complex transactions within a reasonable amount of time. This is achieved by implementing an efficient model of the EVM to offload computation from the Web3 client.

Opera utilizes a major part of the Ethereum Virtual Machine (EVM) in the backend. Smart contracts are written in Solidity and they can function on Opera as they do on Ethereum.

To deploy a smart contract, you send an Opera transaction containing your bytecode without specifying any recipients. You will need FTM tokens to pay the gas fees when deploying smart contracts. To request your testnet FTMs on the testnet, you can use the .

After the contract is deployed, it will be available to all users of the Opera network. Smart contracts have an Opera address like other accounts.

Opera's canonical stablecoin is USDC.e, supported by Circle and Wormhole.

USDC.e on is bridged from native USDC, located in a smart contract on Ethereum, and holds the potential to be upgraded to native USDC in the future by . It's the official, endorsed stablecoin of the Opera ecosystem.

To bridge USDC from Ethereum to Opera, use . You will receive USDC.e on Opera upon completion, which is the canonical stablecoin for our chain.

npx hardhat verify --contract contracts/YourContractFile.sol:YourContractName --constructor-args scripts/argument.js --network testnet {contract address}truffle run verify YourContract@{contract address} --network testnetProject A receives 37% of the fee (0.00629 FTM).

Project B receives 63% of the fee (0.01071 FTM).

The total reward still adds up to 100% of the 0.017 FTM GasM fee, ensuring no over-distribution.

--gcmode full, which prunes old VM tries. It will need more RAM. Often, --cache 15000 (or more RAM) is required to ensure normal operation in this mode.Light gcmode: The light gcmode version (adopted from geth) is less aggressive. It is used by --gcmode light flag. It requires less RAM usage than full gcmode.

Examine contract code at all levels, including bytecode, decompiled representations, and source code, if available.

Check token balances and allowances ‒ both as grantor and grantee ‒ for every contract and account.

Read the values of storage locations of a contract.

Find identical contracts, as well as similar public functions.

Interact with a contract (“read/write contract”), even if it has no published source code.

Decompile arbitrary bytecode ‒ for instance, to examine attack contracts or to see if high-level code is translated into gas-efficient sequences.

Examine transaction traces and effects, filter past actions by function, and perform local debugging of transactions.

Staking rewards minus a 15% fee paid to delegated validator

Staking rewards plus a 15% fee from delegators' rewards

Passive

✅

❌

Minimum requirements

1 FTM

50,000 FTM

Needed expertize

None

Technical

Rewards

Default logging level is INFO.

Percentile options (1-99th percentile)

CallBack

$ git clone https://github.com/Fantom-foundation/fantom-api-graphql.git$ cd fantom-api-graphql

$ go build -o ./build/apiserver ./cmd/apiserver$ build/apiserverserver:

bind: 127.0.0.1:16761

lachesis:

url: /var/opera/data/lachesis.ipc

log:

level: Debug

mongo:

url: mongodb://127.0.0.1:27017

cors:

origins: *// Change maxFeePerGas and maxPriorityFeePerGas as per the current gas prices

var transaction = {

to: TO_ADDRESS,

from: address,

nonce: nonceVal,

value: testWeb3.utils.toHex(testWeb3.utils.toWei('0.1', 'ether')),

gas: testWeb3.utils.toHex(21000),

maxFeePerGas: '0x174876E800', // 100 Gwei

maxPriorityFeePerGas: '0xBA43B7400', // 50 Gwei

chainId

};Block Explorer URL: https://ftmscan.com/

Block Explorer URL: https://ftmscan.com/

Bytecode (compiled code) of your smart contract

FTM for gas costs

Deployment script/plugin

Access to an Opera node, either by running your own node or API access to a node

If you are deploying a smart contract on Opera for the first time, you may take a look at the example given here.

The repository contains the materials to deploy a smart contract using Hardhat and Truffle tools. Instructions to work with the mainnet and testnet are included.

If you want to deploy a smart contract using Remix to the Opera testnet, you just need to connect MetaMask to the Opera Testnet and choose Injected Provider - MetaMask in the Environment option.

You can see that the network ID is set to 4002, which is the Opera testnet's chain ID. When you deploy the contract, it will be deployed to the Fantom testnet.

Hardhat: Development environment for editing, compiling, debugging, and deploying your smart contracts using the EVM.

Truffle: Development environment, testing framework, and asset pipeline for blockchains using the EVM.

Remix: IDE that’s used to write, compile, debug, and deploy Solidity code in your browser.

Solidity: Solidity is an object-oriented, high-level programming language for implementing smart contracts.

: OpenZeppelin Contracts helps you minimize risk by using battle-tested libraries of smart contracts for Ethereum and other blockchains.

: Complete Web3 development framework that provides everything you need to connect your applications and games to decentralized networks.

You can only bridge USDC from Ethereum and not from any other chains. For other assets, please refer to Squid Router.

According to Circle, the differences between native USDC and bridged USDC are:

Unlike native USDC, bridged USDC isn’t minted by Circle itself. On Opera, USDC.e is minted by Wormhole, bridged from native USDC located in a smart contract on Ethereum. At any point, Circle can then obtain ownership of the USDC.e token contract on Opera and upgrade it to native USDC.

Circle has outlined these steps for upgrading bridged USDC to native USDC:

Wormhole has deployed USDC.e on the network

USDC.e is used to bootstrap initial liquidity in the ecosystem

USDC.e reaches a significant supply, amount of holders, and number of app integrations

Circle and the Fantom Foundation/Wormhole jointly elect to securely transfer ownership of the USDC.e token contract to Circle

Upon obtaining ownership, Circle upgrades USDC.e to native USDC and seamlessly retains existing supply, holders, and app integrations

The Fantom Foundation will provide liquidity for the USDC.e stablecoin on Wormhole, making it easy for the token to spread across the network and for users to bridge assets to Opera. As USDC.e begins to proliferate and gain a vast amount of holders and app integrations, Circle may consider stepping in to upgrade its token contract to native USDC.

In this scenario, the upgrade would be seamless and wouldn’t require developers to update contract addresses or users to swap to the new token. The automatic changeover ensures that native USDC on Opera can leverage the built-up USDC.e liquidity so there isn't any interruption on the network.

This page outlines token migration options for apps from Fantom Opera to the Sonic chain.

It provides comprehensive guidance for both token holders and project owners regarding their migration options.

The official Sonic Labs upgrade portal will facilitate the FTM to S upgrade on a 1:1 basis.

If you hold FTM on a centralized exchange, we’re collaborating with major exchanges to enable users to upgrade FTM to S directly on their platforms. Stay tuned for updates from the CEX where you hold your FTM.

Alternatively, you can withdraw your FTM to Fantom Opera and upgrade to S through our .

Users will be able to unlock their staked FTM and bridge immediately to Sonic following a 24-hour withdrawal waiting period. The new Sonic staking system features:

If you hold liquidity positions, you'll need to:

Break existing LP positions on Fantom

Migrate each token individually following their specific processes

Recreate your positions on Sonic

Contact your token's project team to learn their specific migration plan. Each project will choose between migration options such as:

Bridge migration through LayerZero

Airdrop migration based on snapshots

Hybrid approach combining both methods

In this guide, we will walk you through the steps of using Remix, MetaMask, and GetBlock RPC endpoints, all of which are popular developer tools, to create and deploy a simple smart contract on Opera. Note that this tutorial will use the Opera testnet, but the steps remain the same for the mainnet.

Before we begin, make sure you have the following:

MetaMask or another Web3 wallet

Remix: An online IDE used to write, compile, deploy, and debug Solidity code

GetBlock API key: GetBlock provides access to RPC endpoints for various blockchain networks, including Opera

To obtain an API key from GetBlock, register on and find the API key in your account

GetBlock RPC endpoint

To obtain an RPC endpoint from GetBlock, register on and add a new endpoint by choosing Opera (Fantom) as the protocol and testnet as the network

Open MetaMask and set up a custom network with the following details:

Network Name: Opera Testnet

New RPC URL: The GetBlock RPC endpoint you created

Chain ID: Obtain the Chain ID for Opera from GetBlock documentation or API (e.g. 4002)

Visit the

Input your MetaMask wallet address

Complete the CAPTCHA and request the testnet FTM

Go to the

On the Remix home page, choose the Solidity environment

With the Opera network selected in MetaMask, go to Remix and click the Deploy and Run Transactions button on the left side, which is the fourth button

In the Remix environment section, select Custom - External HTTP Provider and enter the GetBlock RPC endpoint URL you created for Opera

Click the File Explorer button on the left side on Remix, which is the first button

Right click and choose New File to create a new Solidity file

Enter the file name as "SimpleStorage.sol"

Copy and paste the following example Solidity code into the SimpleStorage.sol file:contract SimpleStorage {

Click the Solidity Compiler button on the left side, which is the third button

Enable auto-compile for convenience

Click the Compile SimpleStorage.sol button

Check for the green sign indicating successful compilation

Click the Deploy and Run Transactions button on the left side, which is the fourth button

Select the SimpleStorage.sol contract from the dropdown menu

Click the Deploy button

Confirm the transaction in the MetaMask pop-up window

Use the to explore transactions and contracts on the Opera network

Paste the transaction hash into the search field at the top of the screen to view the details of your transaction

In Remix, under the Deploy and Run Transactions section, expand the SimpleStorage contract by clicking the > symbol

The orange buttons represent functions that change information on the blockchain (state changes) and require gas to execute

The blue buttons represent read-only functions that do not modify the blockchain and do not require gas

Get function

Click the Get button to retrieve the stored value, but since we have not set any value yet, it will return the default value

Set function

Enter a value in the field next to the

Congratulations! You have learned how to use Remix, MetaMask, and GetBlock RPC endpoints to create and deploy a smart contract on Opera.

This guide demonstrates the compatibility of Ethereum developer tools with Opera, providing you with options for building decentralized applications on both platforms.

If you have any feedback or questions, you may ask them on the .

To create a new smart contract using the thirdweb CLI, follow these steps:

In your CLI run the following command:

Input your preferences for the command line prompts:

Give your project a name

Choose your preferred framework: Hardhat or Foundry

Name your smart contract

Choose the type of base contract: Empty, , , or

Once created, navigate to your project’s directory and open in your preferred code editor.

If you open the contracts folder, you will find your smart contract; this is your smart contract written in Solidity.

The following is code for an ERC721Base contract without specified extensions. It implements all of the logic inside the contract, which implements the standard.

This contract inherits the functionality of ERC721Base through the following steps:

Importing the ERC721Base contract

Inheriting the contract by declaring that our contract is an ERC721Base contract

After modifying your contract with your desired custom logic, you may deploy it to Opera using .

Alternatively, you can deploy a prebuilt contract for NFTs, tokens, or marketplace directly from the thirdweb Explore page:

Go to the thirdweb Explore page:

Choose the type of contract you want to deploy from the available options: NFTs, tokens, marketplace, and more.

Follow the on-screen prompts to configure and deploy your contract.

Deploy allows you to deploy a smart contract to any EVM-compatible network without configuring RPC URLs, exposing your private keys, writing scripts, and other additional setups, such as verifying your contract.

To deploy your smart contract using deploy, navigate to the root directory of your project and execute the following command:

Executing this command will trigger the following actions:

Compiling all the contracts in the current directory.

Providing the option to select which contract(s) you wish to deploy.

If you have any further questions or encounter any issues during the process, please reach out to thirdweb support at .

If your node is stopped (for any reason), please examine the server log to identify if there were any issues. After fixing the issues (if any), you can run the node in read mode to sync to the latest block. After it is synced up, you can stop the node and run in validator mode.

Make sure your node is synced in read mode first before it is run in validator mode.

If you'd like to migrate your node to a new server, please follow these steps:

Set up a read node on a new server and allow it to run to sync to the latest block.

Stop the old node for at least 40 minutes before running the validator mode on the new server

After the old node is stopped for 40 minutes, then you can run in validator mode on the new server. You should not let the old node run again as it will result in a double-sign and slashing of your validator node.

Find the running process of opera using ps and then kill the process by id.

After your node is stopped, if you want to rerun it, don't run directly in validator mode. Instead, please make sure your node is synced in read mode first before it's run in validator mode.

If your validator node is down for more than 5 days, then it will become offline (i.e. pruned from the network).

For offline nodes, you can undelegate and wait for 7 days to withdraw (bonding time). After that, you can transfer funds to a new wallet and make a new validator if you wish. If undelegating a locked stake or locked delegation before the locked period has expired, it will incur a penalty.

To shut down a node permanently, you can simply stop running the node in validator mode for 5 days or more.

If your node stake is locked, you will first need to call unlockStake() to unlock it. Note that a penalty will apply for early unlocking before the . Then you can call undelegate(), to . Then there is a waiting period of 7 days (so-called bonding time) after undelegation. This is required before you can call withdraw() to take out your stake.

If your node is in a dirty state (it may happen occasionally), please run:

opera --db.preset legacy-ldb db heal --experimental

alternatively, you may do a fresh resync as follows:

Stop the node

Remove the current (broken) datadir (the default datadir is located at ~/.opera)

Download and build the latest version go-opera 1.1.3-rc5

Run your node again in read mode

Check your machine specs if it meets the minimum requirements.

IOPS greater than 5000 (higher is better)

Connection speed > 1 Gbps (some run with 10 or 20 if they can)

Cores: More than 4 cores (the number of cores is not important unless you will use it for serving API calls)

CPU: > 3 GHz.

You can also check the following flags if you're using them to run your node. You can adjust to values suitable to your usage.

Maxpeers Flag: default is 50, you can adjust it depending on your machine

Cache Flag: --cache 15792 (A larger value can give better performance)

Gcmode: Gcmode is not enabled by default. If enabled, (light or full) will take some extra CPU and time

You can also increase the value of on your machine.

You can check your current limit value on Linux with the command ulimit -n. The default value of 1024 may be not enough in some cases.

You can adjust the value to the recommended 500.000 open files limit by either:

ulimit -n 500000

Change it in the /etc/security/limits.conf configuration file, limit type nofile.

In the proxy pattern, we have two smart contracts: proxy contract and implementation contract.

The proxy contract acts as a proxy, delegating all calls to the contract it is the proxy for. In this context, it will also be referred to as the Storage Layer. The implementation contract is the contract that you want to upgrade or patch. This is the contract that the Proxy contract will be acting as a proxy for. In this context, it is the Logic Layer.

The Proxy contract stores the address of the implementation contract or logic layer as a state variable. Unlike normal contracts, the user doesn't actually send calls directly to the logic layer, which is your original contract. Instead, all calls go through the proxy and this proxy delegates the calls to this logic layer — the implementation contract at the address that the proxy has stored — returning any data it received from the logic layer to the caller or reverting for errors.

The key thing to note here is that the proxy calls the logic contract through the delegatecall function. Therefore, it is the proxy contract that actually stores state variables, i.e. it is the storage layer. It is like you only borrow the logic from the implementation contract (logic layer) and execute it in the proxy's context affecting the proxy's state variables in storage.

Openzeppelin provides a library to create an upgradeable proxy pattern called TransparentUpgradeableProxy.

Below are two samples of the creation of a TransparentUpgradeableProxy, one in Hardhat using @openzeppelin/hardhat-upgrades and the other one in Truffle using @openzeppelin/truffle-upgrades

When you deploy, the package behind the scenes creates a ProxyAdmin and a TransparentUpgradeableProxy as well.

In the Hardhat configuration, you just need to verify the TransparentUpgradeableProxy. The Hardhat utility will also verify the ProxyAdmin and the logic smart contract, Box. Unfortunately, in the Truffle configuration, we can’t do this. We can only verify the logic smart contract.

We can create the proxy and proxy admin explicitly by inheriting TransparentUpgradeableProxy in @openzeppelin/contracts/proxy/transparent/TransparentUpgradeableProxy.sol and ProxyAdmin in @openzeppelin/contracts/proxy/transparent/ProxyAdmin.sol.

Below are two samples of creating the proxy and proxy admin explicitly.

Unfortunately, MyProxy can’t be verified using the command line in Hardhat or Truffle, but we can flatten it and then verify it on FTMScan directly.

Below are the most frequently asked questions specifically regarding the migration process from Fantom Opera to Sonic.

Estimated rewards calculation uses the current status of the blockchain to approximate the amount of FTM rewarded for participating in staking. The network uses a proof-of-stake consensus variant to ensure the security of the data inside the blockchain structure.

To calculate the rewards, we use the baseRewardPerSecond value of the latest sealed epoch, but the total staked amount of tokens is calculated elsewhere. The epoch provides the total value of self-staked tokens and the amount of total delegated tokens within that epoch. However, the self-staked total does not account for temporarily offline nodes and includes delegated stakes in the process of being undelegated. Consequently, this value is not accurate for our calculations.

To get the current total staked value, we iterate all the staking records and collect the total staked amount from individual staking.

npx thirdweb create contract

import "@openzeppelin/contracts/proxy/transparent/TransparentUpgradeableProxy.sol";Nodes in the network maintain an exact copy of the ledger, allowing applications built on top of the consensus protocol to function correctly.

Finality means that any party cannot change or reverse a transaction. ABFT consensus algorithms, such as the one Opera uses, have a very low time to finality because they achieve absolute finality. Absolute finality means a transaction is considered final once included in a block. In the case of Opera, the chain can achieve finality in 1–2 seconds.

Conversely, Nakamoto consensus protocols rely on probabilistic finality. In this case, the probability that a transaction will not be reverted increases with time. The more blocks created on top of a block, thereby confirming it as correct, the more difficult and costlier it would be to revert a transaction in that block. At some point, it becomes theoretically impossible to alter older blocks, increasing the probabilistic finality to nearly 100%.

Bitcoin has a finality of 30–60 minutes; when using Bitcoin, you must wait a few block confirmations before considering the transaction final and irreversible. Ethereum has a finality of a few minutes.

Opera has an ERC-20 token, but it cannot be used directly on the Opera chain.

Here is a breakdown of the different FTM tokens in circulation at the moment:

1. Opera FTM: Used on the Opera chain 2. ERC-20: Exists on the Ethereum network

Note that Opera addresses share the same structure as Ethereum addresses (0x…), but they are not Ethereum addresses.

No. You need to transfer them over to Opera using a bridge.

The FTM token has several use cases within the Opera ecosystem. It is essential for a well-functioning, healthy network.

Securing the network Opera uses a proof-of-stake system that requires validators to hold FTM. Anyone with at least 50,000 FTM can run their validator node to earn rewards and secure the network. Every FTM holder can delegate their tokens to a validator (while keeping full custody of their funds) to receive staking rewards. Validators then charge a small fee for their services. By locking in their FTM, validators help the network to be decentralized and secure.

Paying for network fees To compensate validators for their services and prevent transaction spam, every action performed within the Opera network costs a small fee, paid in FTM.

Voting in on-chain governance Decisions regarding the Opera ecosystem are made using transparent on-chain voting. Votes are weighted according to the amount of FTM held by an entity. 1 FTM equals 1 vote.

Additional use cases FTM is used to earn APR/APY on many DeFi platforms.

Check out our guide.

You cannot stake FTM on exchanges at the moment.

To run a validator node on the Opera chain, the following is required:

A minimum stake of 50,000 FTM

Google GCP N2 instance or AWS i3en.xlarge with 4 vCPUs (3.1 GHz) and at least 1TB of local NVMe SSD storage (or equivalent).

Check out our guide.

You can store FTM on various hardware and hot wallets. Check out the Wallets section to learn more.

Opera is our mainnet, a fully decentralized blockchain network with smart contract support. It is compatible with the Ethereum Virtual Machine and powered by our ABFT consensus algorithm. Thus, smart contracts developed on Ethereum can run on Opera, increasing scalability and security.

Yes. Fantom is fully compatible with the Ethereum Virtual Machine (EVM) and supports Web3JS API and RPC.

All smart contracts written in Solidity or Vyper, compiled and deployed on Ethereum, are fully compatible with Opera.

Opera supports all the smart contract languages Ethereum supports for the EVM, including Solidity and Vyper.

The Opera chain went live on December 27, 2019.

The Fantom Foundation is currently in charge of the network's governance, advised by the community and validator nodes.

Find out more details on how governance works on Opera.

The delegation limit is determined by multiplying the staker's current self-staked amount by a fixed rate specified in the SFC contract. Currently, the maximum allowed delegations are set at 15 times the self-staked FTM.

To calculate the remaining delegation limit, we subtract the current delegated amount from the total limit. This value is provided by the API, so you don't need to perform the calculation manually. Note that tokens in the process of undelegation are not included in the delegated amount and therefore do not count towards the delegation limit.

Native USDC

Issued by Circle, a regulated fintech company

Backed by US dollars and always redeemable 1:1

Official form of USDC on a given blockchain

Interoperable with multiple blockchain networks via Circle’s Cross-Chain Transfer Protocol

Bridged USDC

Created by a third party, e.g. Wormhole

Backed by native USDC on another blockchain locked in a smart contract

Not compatible with Circle’s Cross-Chain Transfer Protocol

Upgradable to native USDC

Symbol: FTM

Block Explorer URL: https://explorer.testnet.fantom.network

Once confirmed, you will see a message at the bottom right indicating the pending creation of the SimpleStorage contract

You can click on the transaction line or the debug button to view more details of the transaction

Copy the transaction hash for future reference

Click the Set button

Confirm the transaction in the MetaMask pop-up window

Wait for the transaction to be confirmed

After confirmation, you can check the transaction details in the bottom-right section

Add any desired extensions

Implementing any required methods, such as the constructor.

When it is completed, it will open a dashboard interface to finish filling out the parameters.

_name: contract name

_symbol: symbol or "ticker"

_royaltyRecipient: wallet address to receive royalties from secondary sales

_royaltyBps: basis points (bps) that will be given to the royalty recipient for each secondary sale, e.g. 500 = 5%

Select Opera (Fantom) as the network

Manage additional settings on your contract’s dashboard as needed such as uploading NFTs, configuring permissions, and more.

Foundry is a development toolkit to work with smart contracts.

In your project directory, run foundry init. This will create a boilerplate project.

You need to pay gas on the network to deploy the contract. Get testnet FTM through the faucet.

In the initialized Foundry project in src/, create HelloWorld.sol:

At this point, you are ready to deploy your contract:

You have your own node on the Opera testnet through which you will deploy the contract.

You have Foundry that you will use to deploy the contract.

You have a funded account that will deploy the contract.

To deploy the contract, run:

CONTRACT_PATH — path to your HelloWorld.sol file.

PRIVATE_KEY — the private key from your account.

HTTPS_ENDPOINT — your node's endpoint.

Example:

Congratulations! You have deployed your Hello World smart contract on Opera!

Open up port 22 for SSH, as well as port 7946 for both TCP and UDP traffic. A custom port can be used with "--port <port>" flag when running your Opera node.

You are still logged in as the new user via SSH. Now we are going to install Go and Opera.

First, install the required build tools:

You can run your read node using go-opera 1.1.3-rc.5 (full sync or snapsync mode).

Validate your Opera installation:

db.preset

When using version 1.1.3, you need to add the db.preset argument (introduced since 1.1.2) to the starting Opera command. You can see options for this parameters with opera help command. For standard conditions, please use this option:

db.preset=ldb-1

You can use different db presets, either --db.preset ldb-1 OR --db.preset legacy-db or --db.preset pbl-1. Note that ldb-1 is recommended.

Download a genesis file from this list of genesis files.

You can start a node with a syncmode flag. There are two possible options:

"--syncmode snap", and

"--syncmode full" (by default).

For archive node and validator node, you should use full syncmode.

For the latest update, please check our GitHub.

uint storedData;

function set(uint x) public {

storedData = x;

}

function get() public view returns (uint) {

return storedData;

}

}

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.0;

import "@thirdweb-dev/contracts/base/ERC721Base.sol";

contract Contract is ERC721Base {

constructor(

string memory _name,

string memory _symbol,

address _royaltyRecipient,

uint128 _royaltyBps

) ERC721Base(_name, _symbol, _royaltyRecipient, _royaltyBps) {}

}

npx thirdweb deploy

// SPDX-License-Identifier: None

// Specifies the version of Solidity, using semantic versioning.

// Learn more: https://solidity.readthedocs.io/en/v0.5.10/layout-of-source-files.html#pragma

pragma solidity >=0.8.9;

// Defines a contract named `HelloWorld`.

// A contract is a collection of functions and data (its state). Once deployed, a contract resides at a specific address on the Fantom blockchain. Learn more: https://solidity.readthedocs.io/en/v0.5.10/structure-of-a-contract.html

contract HelloWorld {

//Emitted when update function is called

//Smart contract events are a way for your contract to communicate that something happened on the blockchain to your app front-end, which can be 'listening' for certain events and take action when they happen.

event UpdatedMessages(string oldStr, string newStr);

// Declares a state variable `message` of type `string`.

// State variables are variables whose values are permanently stored in contract storage. The keyword `public` makes variables accessible from outside a contract and creates a function that other contracts or clients can call to access the value.

string public message;

// Similar to many class-based object-oriented languages, a constructor is a special function that is only executed upon contract creation.

// Constructors are used to initialize the contract's data. Learn more:https://solidity.readthedocs.io/en/v0.5.10/contracts.html#constructors

constructor(string memory initMessage) {

// Accepts a string argument `initMessage` and sets the value into the contract's `message` storage variable).

message = initMessage;

}

// A public function that accepts a string argument and updates the `message` storage variable.

function update(string memory newMessage) public {

string memory oldMsg = message;

message = newMessage;

emit UpdatedMessages(oldMsg, newMessage);

}

}forge create HelloWorld --constructor-args "Hello" --contracts CONTRACT_PATH --private-key PRIVATE_KEY --rpc-url HTTPS_ENDPOINTforge create HelloWorld --constructor-args "Hello" --contracts /root/foundry/src/HelloWorld.sol --private-key d8936f6eae35c73a14ea7c1aabb8d068e16889a7f516c8abc482ba4e1489f4cd --rpc-url https://nd-123-456-789.p2pify.com/3c6e0b8a9c15224a8228b9a98ca1531d# Install build-essential

(validator)$ sudo apt-get install -y build-essential

# Install go

(validator)$ wget https://go.dev/dl/go1.19.3.linux-amd64.tar.gz

(validator)$ sudo tar -xvf go1.19.3.linux-amd64.tar.gz

(validator)$ sudo mv go /usr/local

# Export go paths

(validator)$ vi ~/.bash_aliases

# Append the following lines

export GOROOT=/usr/local/go

export GOPATH=$HOME/go

export PATH=$GOPATH/bin:$GOROOT/bin:$PATH

#

source ~/.bash_aliases# Install Opera

(validator)$ git clone https://github.com/Fantom-foundation/go-opera.git

(validator)$ cd go-opera/

(validator)$ git checkout release/1.1.3-rc.5

(validator)$ make$./build/opera help

VERSION:

1.1.3-rc.5# Start opera node

(validator)$ cd build/

(validator)$ wget https://download.fantom.network/testnet-6226-no-mpt.g

(validator)$ nohup ./opera --genesis testnet-6226-no-mpt.g --nousb \

--db.preset ldb-1 &LayerZero

Technical OFT setup

Stargate

Limitations

Burnt LP remains on Fantom

If LP was sent to SCC, it can be bridged and recreated

Original token contract stays on Fantom (generally not an issue)

Deploy new token contract on Sonic with snapshot-based airdrop distribution.

Special Cases Requirements

Multisigs

Yes

Different addresses on Sonic

LP tokens

Yes

Snapshot by LP weights

Burnt tokens

Optional

Can redistribute on Sonic

Initial LP

Yes

Advantages

Works for burnt tokens and LPs

No bridge needed

Limitations

Special handling for LP and multisig holders

More preparation work needed

Recreation of initial burnt LP requires additional funds

Deploy new token on Sonic

Enable bridging of original tokens

Create migration contract for 1:1 swaps

Allow two-way conversion initially

Switch to one-way later

Example Implementation

New contract: sonicBeets

Users bridge fantomBeets to Sonic

Migration contract handles 1:1 exchange

Two-way conversion for limited time

Mirrors official FTM → S migration process

Initial period

December 18, 2024 – March 31, 2025

Two-way FTM ↔ S

Full flexibility

Final phase

Indefinite

One-way FTM → S

No reverse conversion

Withdrawal period

14 days

Minimum stake

1 S

An Airnode is a first-party oracle that pushes off-chain API data to your on-chain contract. Airnode lets API providers easily run their own oracle nodes. That way, they can provide data to any on-chain app that's interested in their services, all without an intermediary.

dAPIs are continuously updated streams of off-chain data, such as the latest cryptocurrency, stock and commodity prices. They can power various decentralized applications such as DeFi lending, synthetic assets, stablecoins, derivatives, NFTs, and more.

The data feeds are continuously updated by first-party oracles using signed data. App owners can read the on-chain value of any dAPI in real-time. Due to being composed of first-party data feeds, dAPIs offer security, transparency, cost-efficiency, and scalability in a turn-key package.

Apart from relying on deviation threshold and heartbeat configuration updates, unlike traditional data feeds, OEV Network enables apps using dAPIs to auction off the right to update the data feeds to searcher bots. Searcher bots can bid for price updates through the OEV Network to update the data feeds. All the OEV proceeds go back to the app.

The API3 Market enables users to connect to a dAPI and access the associated data feed services. Click here to learn more about how dAPIs work.

The API3 Market lets users access dAPIs on both the Opera mainnet and testnet.

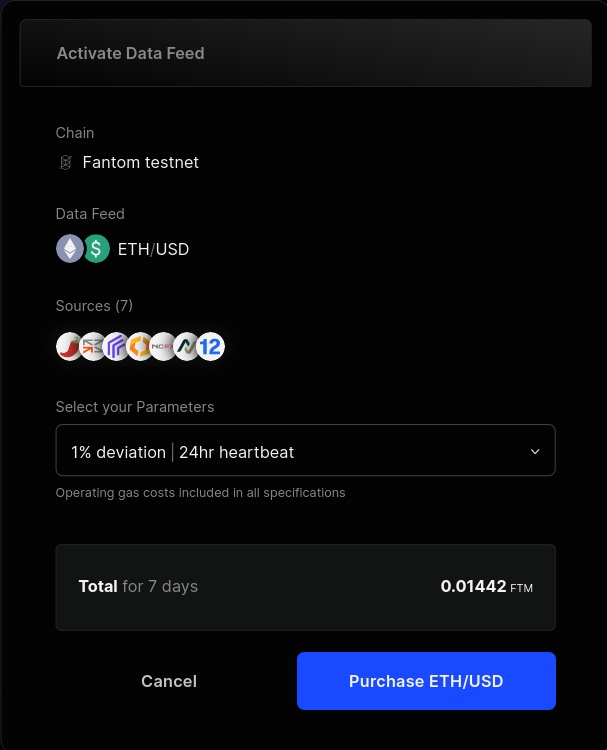

The API3 Market provides a list of all the dAPIs available across multiple chains, including testnets. You can filter the list by mainnet or testnet chains. After selecting the chain, you can now search for a specific dAPI by name. Once selected, you will land on the details page (eg ETH/USD on the Opera Testnet) where you can find more information about the dAPI.

The currently supported configurations for dAPIs are:

0.25%

24 hours

0.5%

24 hours

1%

24 hours

5%

24 hours

If a dAPI is already activated, make sure to check the expiration date and update the parameters. You can update the parameters and extend the subscription by purchasing a new configuration.

After selecting the dAPI and the configuration, you will be presented with an option to purchase the dAPI and activate it. Make sure to check the time and amount of the subscription. If everything looks good, click on Purchase.

You can then connect your wallet and confirm the transaction. Once it's confirmed, you will be able to see the updated configuration for the dAPI.

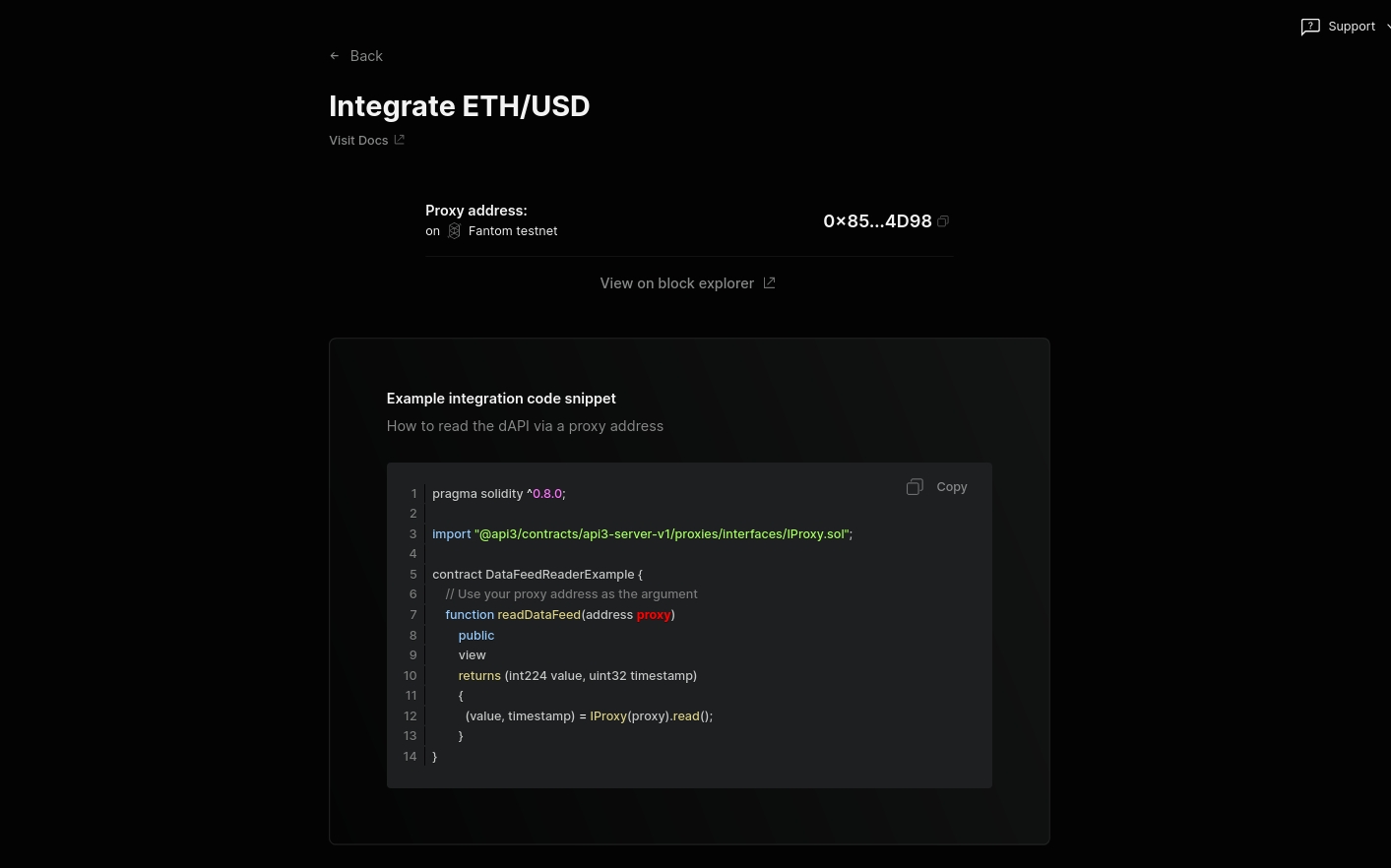

Once you are done configuring and activating the dAPI, you can now integrate it. To do so, click on the Integrate button on the dAPI details page.

You can now see the deployed proxy contract address. You can now use this to read from the configured dAPI.

Here's an example of a basic contract that reads from a dAPI:

setProxyAddress() is used to set the address of the dAPI Proxy Contract.

readDataFeed() is a view function that returns the latest price of the set dAPI.

You can read more about dAPIs here.

Here are some additional developer resources:

The core idea of the GraphQL API is to describe available entities and attributes with a schema and let the client decide which parts, elements, and services it needs to perform its operation. Our schema is extensively commented and you should be able to grab the right data just by comparing your needs with the schema. Please let us know if you still miss anything important.

The API follows these conventions and recommendations:

GraphQL types are capital camelCases.

Attributes are regular camelCases.

Function calls are named and managed the same way as attributes.

Complex input and output values are encapsulated in a type instead of an expanded list.

The API uses several different scalar values besides the default GraphQL set. Most of them encode big values or byte arrays of hashes and addresses. If your client application is built using JavaScript, or TypeScript, you can benefit from using the excellent library, which can help you deal with the decoding and validating process of most data types used here.

Transaction amounts, account balances, rewards, and basically all amount-related data are transferred as big integers encoded in prefixed hexadecimal format. It represents the smallest indivisible amount of value inside the blockchain, the so-called WEI.

One FTM token contains 10¹⁸ WEIs.

The following scalar values are used by the API:

Hash is a 32-byte binary string, represented by 0x prefixed hexadecimal number.

Address is a 20-byte Opera address, represented by 0x prefixed hexadecimal number.

BigInt is a large integer value. Input is accepted as either a JSON number or a hexadecimal number alternatively prefixed with 0x. Output is 0x prefixed hexadecimal.

Long is a 64-bit unsigned integer value represented by 0x prefixed hexadecimal number.

The API employs cursor-based pagination instead of the commonly used <offset, count> or <from, to> architectures, which rely on numeric offsets from the top of the collection. In our scenario, the top of the collection is constantly changing, making it nearly impossible to track your position with a shifting anchor.

Our approach uses a cursor system, where each member of the collection has a unique identifier called a cursor. To obtain a slice of the collection, you specify the cursor value of a member and the number of neighboring members you need. If you don't specify a cursor, it defaults to either the top or bottom of the collection, determined by the count of neighbors you request.

For example, this query provides 15 consecutive blocks after the one with the cursor "0x134b7":

If you just want the 10 most recent transactions, you skip the cursor and send the following query:

Please note that each response will contain several important bits of info that will help you navigate through the collection.

First is the pageInfo structure, defined by PageInfo type. It contains the first and last cursor of your current slice so you can use these values and ask for next X edges or previous -X edges.

Also each edge of the list contains not only the desired data element, but also a cursor, which can be used to create a link, if desired, to the same position in the collection regardless of the absolute distance of the element from the top or bottom.

Fixed-cap assets are fungible tokens for which the supply is determined at the time of asset creation. No additional quantities can be generated afterward.

Write the token smart contract:

Functions

Fixed-cap assets

constructor(cap)

cap()

Compile your code into bytecode

Deploy your fixed-cap asset by sending your code in a transaction to the Opera network

Navigate to to check that your token has been created